Rmd 2021 calculator

Use our Inherited IRA calculator to find out if when and how much you. Inherited IRA RMD Calculator.

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500.

. Profit-sharing plans 401k plans 403b plans and 457b plans. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Inherited IRA beneficiary tool.

This is the simplest method for calculating your SEPP but it also produces the lowest payment. Required minimum distribution RMD method. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July.

Yet if you reached age 705 in 2020 or later you must now take your first RMD by April 1. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. Use this calculator to determine your Required Minimum Distribution RMD.

Compare todays best CD rates from 423 banks and credit unions ranging from 3-month to 5-year terms. Or 72 if youre subject to the new ruleseven though your second RMD is due on December 31 of that same. The Secure Act raised the RMD age for some taxpayers to 72 but didnt raise the QCD age from 70 12.

Earn up to 460 APY. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs SARSEPs and SIMPLE IRAs. If you reached age 705 in 2019 the prior rule applied and you had to take your first RMD by April 1 2020.

Details of Roth IRA Contributions The Roth IRA has contribution limits which are 6000 for 2022. The IRS charges a 50 penalty on any withdrawals required but not taken. The threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household.

This suggests a possible upside of 143 from the stocks current price. Use this calculator to determine your required minimum distribution RMD. 31 2022 and by Dec.

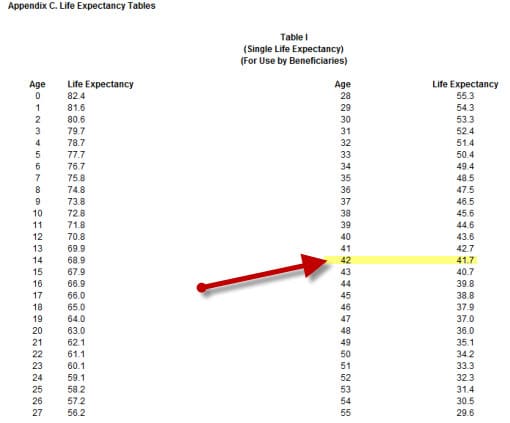

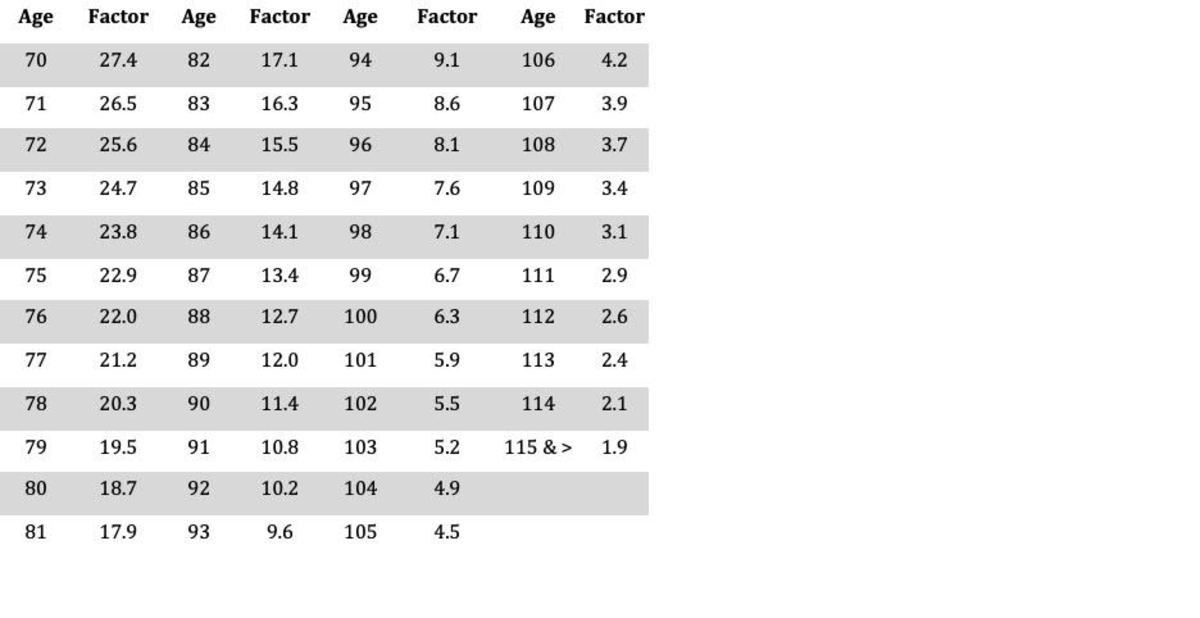

RMD is calculated based on life expectancy and the account balance at the end of the previous year. Heres how to donate your RMD using a qualified charitable distribution. On average they predict the companys share price to reach 26640 in the next year.

Or you can wait and take it in the next year. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. View analysts price targets for RMD or view top-rated stocks among Wall Street analysts.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Their RMD share price forecasts range from 25000 to 28000. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required withdrawals if you are an IRA owner age 70-12 or older or. Schwab offers an online calculator to help investors estimate annual distributions. If you turn age 72 or retire and youre already age 72 or over or were age 70½ or older on December 31 2019 in the first year for which you are required to take RMD you have two choices.

The RMD rules apply to all employer sponsored retirement plans including. Continue reading The post IRS May Close This RMD Loophole appeared first on SmartAsset Blog. RMD amounts depend on various factors such as the.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. Top RMD questions for 2021 Are RMDs suspended in 2021 as they were in 2020. SP 500 for the 10 years ending December 31 st 2021 had an annual compounded rate of return of 136 including reinvestment.

You must take the RMD by April 1 2022. If you turned 72 prior to January 1 2022 you must take your 2022 RMD before December 31 2022. The IRS rules regarding 72tq Distributions are complex.

Use this calculator to determine your allowable 72tq Distribution and how it maybe able to help fund your early retirement. Use this calculator to determine your required minimum distributions RMD from a traditional IRA. So for your 2021 income taxes you can contribute to your Roth IRA up until April 15 2022.

A plan may require you to begin receiving distributions by April 1 of the year after you reach age 70½ age 72 if born after June 30 1949 even if you have not retired. What Is an RMD. The analysis provided by this tool is based solely on the information provided by you.

Calculate the required minimum distribution from an inherited IRA. RMD Stretch IRA Calculator. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

As the name. Investor Using Outside Advisor. Call us at 866-855-5636.

The cost of miscalculating or failing to withdraw the full amount is steep. If you turn 72 in 2022 you first RMD is due by April 1 2023. You can take your first withdrawal the amount required for the first year in that year eg 2021.

The RMD rules also apply to Roth 401k accounts. Terms of the plan govern. You must take your first RMD for 2021 by April 1 2022 with subsequent RMDs on December 31st annually thereafter.

Individual 401k Savings Calculator. If you are a beneficiary of a retirement account use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. A required minimum distribution RMD is the amount of money that you must withdraw from almost all tax-advantaged retirement accounts each year once you turn 72.

Most Americans have at least heard of a 401k plan but there is another tax-advantaged workplace. Which can be obtained by calling 18003452021 contains this and other information about the fund and should be read carefully before investing. Use this calculator for a spouse beneficiary assumes spouse rolls to own IRA or owners death was post 2019 and the beneficiary is a.

For those who are married and filing. Use this calculator to determine your maximum 2021 Individual 401k contribution as compared to three other possible plan options. Youll have to take another RMD by Dec.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. You reached age 72 on July 1 2021. As a reminder if your first RMD was required in 2021 and you havent already taken it please be sure to take your 2021 RMD before April 1 2022.

Rmd Table Rules Requirements By Account Type

Rmd Tables

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Required Minimum Distribution Calculator

How To Calculate Rmds Forbes Advisor

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Rules Sensible Money

Rmd Tables

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

How To Determine And Take Your Rmd Richard A Hall Pc

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Sjcomeup Com Rmd Distribution Table

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account